Is a Non-QM Mortgage right for you?

Non-Qualified Mortgage (Non-QM) programs are designed for borrowers who may not meet the strict guidelines set forth by the Consumer Financial Protection Bureau (CFPB) for Qualified Mortgages (QM). These programs often cater to borrowers with unique financial situations or unconventional income sources.

Here are several types of Non-QM mortgage programs:

- Bank Statement Loans: These loans are designed for self-employed borrowers or those with non-traditional income sources. Instead of using tax returns or W-2s, lenders review bank statements to determine the borrower’s income and ability to repay the loan.

-

Stated Income Loans: These mortgages allow borrowers to simply state their income without providing extensive documentation. These loans are typically designed for self-employed borrowers or those with complex income structures.

-

Asset Depletion Loans: These loans are designed for borrowers with substantial liquid assets but irregular income. Lenders consider the borrower’s assets as a source of income, allowing them to qualify for a mortgage without traditional income documentation.

-

No Ratio Loans: These mortgages do not require the borrower to disclose their debt-to-income (DTI) ratio. They are designed for borrowers with high income but significant debt, or those who have complex financial situations.

- No Income, No Asset (NINA) Loans: These loans do not require the borrower to provide any documentation of income or assets. NINA loans are designed for borrowers with non-traditional income sources or privacy concerns.

-

Non-Owner Occupied Investment Property Loans: These loans cater to real estate investors looking to finance non-owner-occupied properties. Non-QM investment property loans often have more flexible underwriting guidelines and can accommodate higher debt-to-income ratios or lower credit scores.

-

Interest-Only Non-QM Loans: These loans allow borrowers to pay only the interest on their mortgage for a specified period, with more flexible underwriting guidelines than QM interest-only loans.

-

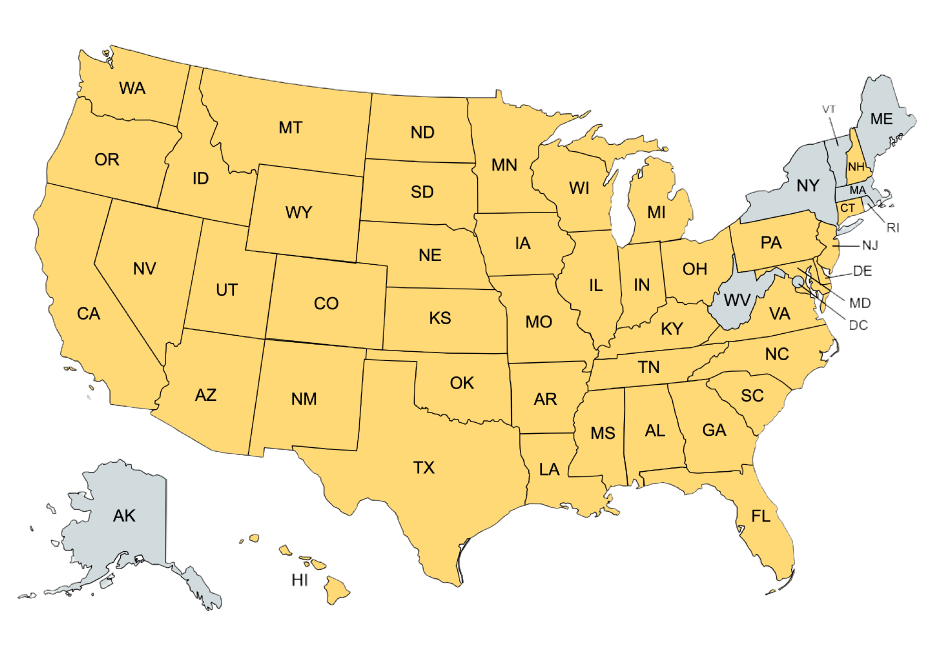

Foreign National Loans: These loans are designed for non-resident foreign nationals seeking to purchase property in the United States. They often come with flexible underwriting guidelines and do not require traditional income documentation or U.S. credit history.

Please note that while Non-QM loans offer more flexibility in underwriting, they often come with higher interest rates and stricter requirements for down payment and reserves due to the increased risk to the lender. At Legacy Lending, we can help you navigate the various Non-QM programs available to find the best fit for your unique financial situation.